iConnections was delighted to welcome more than 220 managers and 230 allocators representing nearly $4 trillion in assets to Global Alts Asia 2024 in Singapore on November 11 – 13th.

These investors represented 17 countries across nearly 2,700 meetings and two days of of content.

This marked iConnections’ third convening in Singapore, and occurred as investors and managers are planning for the second half of a very eventful decade.

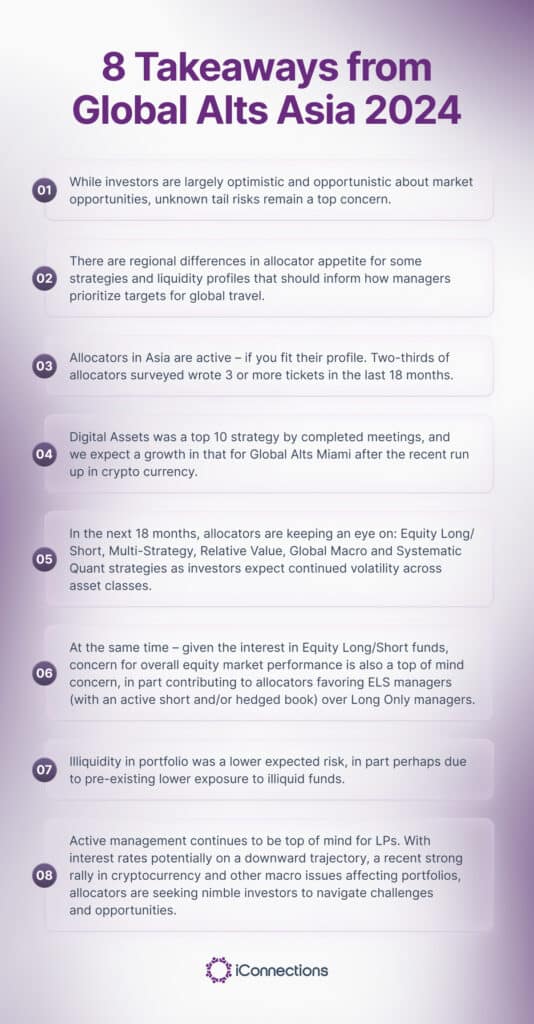

Renewed Central Bank activity, consequential geopolitical events and changing regulatory environments have all left global investors puzzling over asset allocation that suits both short and long-term goals.

In addition to studying meeting patterns and investor appetite, for the first time at Global Alts Asia, we surveyed over 100 allocators to understand the opportunities, challenges and risks of the investment landscape with folks on the ground.

Perhaps unsurprisingly, given the sheer number of surprising market and macro events in recent years, one of their top concerns is explicitly “unknown tail risk.” This tells us investors, while excited about potential opportunities, remain mindful that curve balls and crises do happen, and are squarely taking that into account when constructing portfolios.

As we look towards Global Alts Miami in 2025, we are excited to think about what these high level takeaways mean for alternatives managers and our broader industry. When managers do well, allocators do well – and helping create opportunities for connection and mutual learning contributes to driving our industry forward.